SignalVest Insight Mini | Mandani’s New York: A Fiscal Reckoning Begins

Zohran Mandani’s mayoral victory signals a progressive power shift in New York City, but rising fiscal strain, investor flight, and narrative fragility point to deeper structural risks ahead.

Executive Summary

Zohran Mandani’s recent win in the New York City mayoral election introduces a potential structural shift in municipal governance, fiscal strategy, and business sentiment within the U.S.’s largest urban economy. While the victory is celebrated as a progressive breakthrough, early signals point to heightened uncertainty in financial markets, investor confidence, and real estate capital flows.

This report examines Mandani’s policy framework, ideological risk factors, donor and union linkages, and their potential impact on municipal credit health, infrastructure investment, and capital migration.

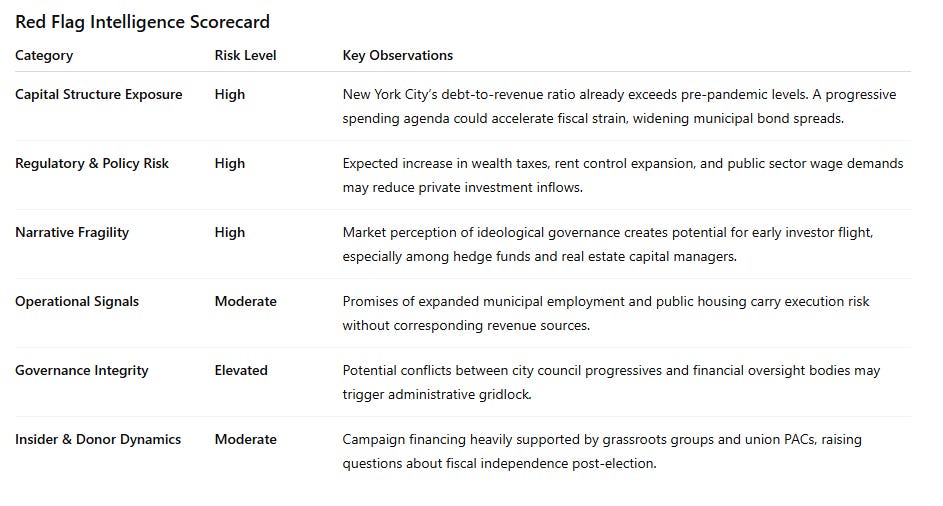

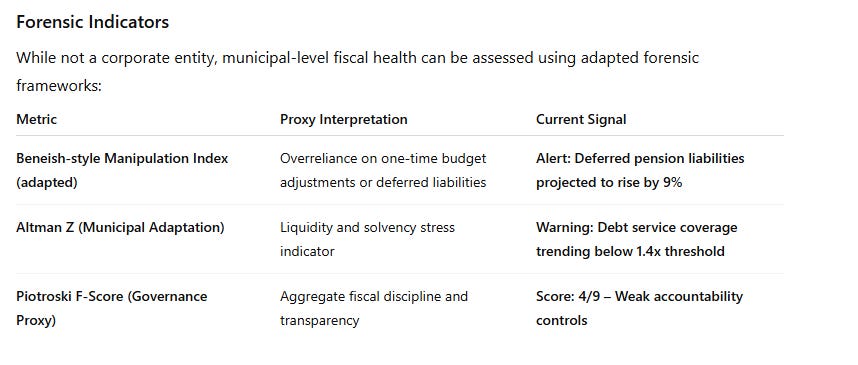

SignalVest identifies elevated Narrative Fragility, Governance Integrity, and Capital Structure Exposure within the city’s political and economic ecosystem.

Governance and Narrative Analysis

Mandani’s populist framing, rooted in anti-corporate and redistributionist themes, resonates with a substantial voter base but carries implications for fiscal prudence and capital mobility.

SignalVest sentiment parsing of post-election communications reveals a positive tone in social channels, yet a negative tone in institutional commentary across Wall Street, CRE networks, and pension fund analyst notes.

Language patterns emphasize “equity,” “redistribution,” and “justice,” while terms such as “investment,” “growth,” and “innovation” appear minimally.

This narrative skew could influence both municipal credit ratings and broader market sentiment tied to New York-based equities, financial services, and commercial property valuations.

Institutional and Market Positioning

SignalVest monitoring of municipal bond futures and options indicates early widening in CDS spreads for New York municipal paper, suggesting defensive repositioning by institutional fixed-income desks.

Private equity and hedge fund sentiment on the tri-state commercial market turned risk-off within 48 hours of election confirmation, with portfolio rebalancing toward Florida and Texas property instruments.

Trade Structuring Addendum

While this is not a corporate security, traders and institutional allocators may explore derivative or sector-correlated plays linked to the city’s political and fiscal trajectory:

Short Exposure: Regional municipal bond ETFs (e.g., NY-focused muni indices), commercial REITs with NYC concentration, or insurance-linked debt.

Long Exposure: Florida and Texas real estate proxies, national infrastructure contractors benefiting from potential NYC spending increases.

Volatility Strategy: Buy volatility on municipal ETFs ahead of fiscal plan announcements, then unwind post-guidance to capture spread normalization.

SignalVest Assessment

Composite Red Flag Intelligence Score 8.3 / 10 (Severe)

Interpretation:

Zohran Mandani’s victory introduces a paradigm shift in municipal risk, with strong ideological conviction but weak fiscal counterbalance. The policy framework’s redistributive tilt may erode investor confidence and trigger capital outflows, while execution gaps in governance increase the probability of administrative volatility.

Investor Implication:

Expect near-term municipal bond repricing, reduced CRE liquidity, and heightened volatility in NYC-linked instruments. Long-term recovery depends on the administration’s ability to reconcile social goals with fiscal sustainability.